Web3 New Economy and Tokenization Whitepaper

By: HashKey Group

Execution Summary

Web3 refers to value networks represented by blockchain, which emphasizes data trustworthiness, data sovereignty, and value interconnection. In Web3, all values can be tokenized and efficiently, intelligently combined, transformed, circulated, and allocated in the Web3 value networks. These values have multi-level property rights implications, and in addition to ownership, the most important is the right to use. For example, only token holders of a certain blockchain network, system, or application have the right to use that network, system, or application. The core of the market for usage rights is stakeholder capitalism. Organizational forms will undergo significant changes, becoming open-source organizations, non-profit organizations, or decentralized autonomous organizations (DAO). The tokenization of usage rights is the key to understanding the development of blockchain infrastructure in the past 15 years.

In the next 15 years, Web3 applications built on blockchain infrastructure will become the new focus of development and have a revolutionary impact on human economic and financial activities, social interactions, and privacy protection in the digital world. The Web3 new economy will create new money markets, capital markets, and commodity markets, requiring the use of different types of tokens as value markers for economic activities, including utility tokens, security tokens, and non-fungible tokens (NFTs), representing usage rights, ownership rights, and digital certificates, respectively. We call this the "three-token model." In the Web3 new economy, the "three tokens" will fulfill their respective functions and fully utilize the stakeholder principle through incentive mechanisms.

The foundation for the healthy development of the Web3 new economy is in-depth research and continuous practice of tokenomics. In tokenomics, monetary policy, mechanism design, and financial engineering are a "trinity" relationship. The goal of monetary policy is to regulate token supply and demand, making the effective supply and circulation speed of tokens adapt to the development needs of the Web3 new economy. The goal of mechanism design is to achieve incentive compatibility through designing dynamic game-theoretic mechanisms and algorithms for decentralized decision-making to coordinate the actions of multiple participants under asymmetric information and inconsistent objectives. The goal of financial engineering is risk-return conversion, designing financial products and markets suitable for the Web3 new economy. The overall goal of tokenomics is to stimulate stakeholders to actively participate in Web3 new economic activities by reasonably designing token supply mechanisms, application scenarios, and related financial products and markets to promote token value growth.

The Web3 new economy will surpass the Internet economy in terms of the economic system, economic organization, financial system, value creation laws, value distribution laws, stakeholders, business models, distributed decision-making mechanisms, and value capture. Unlike the value capture feature of the "thin protocol, fat application" in the Internet economy, the Web3 new economy is "fat protocol, fat application". The underlying protocol stack of the Web3 new economy has built-in money systems and value systems, and value creation can be performed at the protocol layer. At the application layer, the Web3 new economy will integrate many digital technologies, and the space for value creation will be no less than that of the Internet economy.

1. Outlook on the New Web3 Economy

1.1. Web3: Underlying Logic and Evolutionary Trends

Since the mid-19th century, driven by advances in communication technology (CT), information technology (IT), and digital technology (DT), humanity's digital migration has continued to deepen, and our ability to collect and process data has steadily improved. Data has become an unprecedented new driving force for the development of human society and economy, breaking through the limitations of physical time and space, restructuring economic laws, and leading business organizations towards openness, sharing, and collective governance.

Humans are social animals, and the history of human development is also a history of network evolution: from the relationship networks of ancient tribes to various physical forms of public infrastructure networks, and then to the digital web. Networks have deeply influenced human work, life, social, economic, and political aspects.

The digital web is a highly efficient information exchange network that has developed based on the Internet since the end of the last century. The development of the digital web can be divided into three stages. Web 1.0 is an "information network" represented by portal websites. Users can easily obtain various online information, but in most cases, information dissemination is one-way. Web 2.0 is a "data network" represented by social media. Users create a large amount of content and leave behind massive data on online identity and behavior, and information dissemination becomes interactive. Web 2.0 platforms have generated enormous commercial value through the collection and analysis of user data but also created complex governance issues such as weak user privacy protection, platform monopolies, and unpaid use of news content. Web 3.0 is a "value network" represented by blockchain, emphasizing data trustworthiness, data sovereignty, and value interconnection. In Web 3.0, all values can be tokenized and efficiently, intelligently combined, transformed, circulated, and distributed in the Web 3.0 value network. These values have multi-level property rights meanings, and besides ownership, the most important is usage rights.

1.2. The Market for Usage Rights

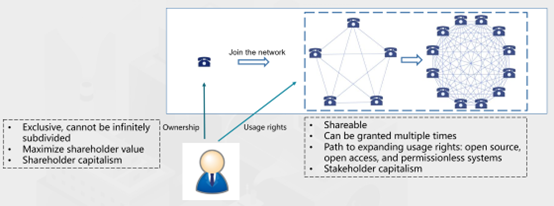

The importance of usage rights is most fully reflected in digital products and services. As shown in Figure 1, physical products can generally only be used by the same entity at the same time, and are accompanied by consumption, wear and tear, and depreciation during use. Digital assets and services generally have high fixed costs, low marginal costs, and non-competitive use. Digital products and services can be used by multiple people at the same time, which can have two effects.

Figure 1: Comparison of Economic Characteristics between Physical Products and Digital Products & Services

In terms of supply, digital products and services have obvious economies of scale - the more produced, the lower the average cost. For example, developing software requires a high amount of investment, but the total cost will not differ significantly whether it is used by one person or one hundred million people after the software is developed.

On the demand side, the economic and social value of using digital products and services is greatly enhanced by network effects when multiple people use them. Kevin Kelly summarized this over 20 years ago as the "fax machine effect." Suppose someone spends $200 to buy a fax machine. Once it is connected to a network of 10 million fax machines, he can exchange faxes with others and enjoy a network value that far exceeds the cost of purchasing one fax machine. Therefore, the fax machine also represents the right to use the fax network.

Figure 2: Ownership and Usage Rights Comparison

Although usage rights and ownership rights belong to different dimensions of property rights, they have significant differences. As shown in Figure 2, ownership is exclusive, and cannot be infinitely subdivided. Under the ownership system, a company's goal is to maximize shareholder value. This is known as shareholder capitalism, which is most evident in the stock market. Usage rights, on the other hand, are shareable and can be granted multiple times, mutually benefiting each other. For many digital products and services, usage rights can theoretically be granted an infinite number of times, and the path to expanding usage rights is through open source, open access, and permissionless systems.

The core of the usage right market is stakeholder capitalism. Organizational forms will undergo significant changes, becoming open-source organizations, non-profit organizations, or decentralized autonomous organizations (DAOs). These organizations pursue the maximization of organizational value (or common interests). All participants in the organization collaborate on a large scale as stakeholders, making their contributions and sharing the value of the organization. In these organizational forms, ownership becomes insignificant, and usage rights are truly valuable. Although usage rights cannot be turned into equity, they can be tokenized.

1.3. Blockchain Holding a Central Position in Web3

Over the past 15 years, with the rapid development of the public chain ecosystem represented by Bitcoin and Ethereum, the underlying technology of blockchain has become mature. The blockchain development mechanism is rooted in the open-source community, embodying characteristics such as openness, sharing, and boundless innovation. Blockchain infrastructure is an important public product that is not owned by anyone or any institution. The distributed ledger of blockchain can extract usage rights from digital products and services, standardize and tokenize them in the form of tokens, and form digital asset markets. Digital asset markets can provide services such as issuance and trading of usage rights on a global scale. In terms of value capture, blockchain embodies the characteristics of "fat protocols, thin applications."

Over the next 15 years, Web3 applications built on blockchain infrastructure will become a new development focus and have a revolutionary impact on human economic and financial activities, social interactions, and privacy protection in the digital world. First, blockchain infrastructure protocols will be the basis for the development of Web3 applications, ensuring the effective operation of business activities on the blockchain through smart contracts. Second, Web3 applications will ensure their systems are trustless, open, transparent, and permissionless through decentralized governance mechanisms, with distributed autonomous organizations (DAOs) becoming the primary organizational form. Finally, non-fungible tokens (NFTs) will serve as proofs of identity, capability, behavior, workload, contribution, activity, and product and service for Web3 application users. Based on these proofs, tokens will serve as incentive tools, establishing effective incentive mechanisms.

With clearer regulatory policies, security tokens will gain significant development. In the distributed economy built around Web3 applications, security tokens, utility tokens, and non-fungible tokens (NFTs) will fully utilize the principle of stakeholder interests through incentive mechanisms based on their respective functions. The new Web3 economy will embed new economic and financial systems, creating economic and social value greater than the two organizational forms of profit-making corporate governance and open-source communities composed of volunteers. These values will be shared by holders of security tokens, utility tokens, and non-fungible tokens (NFTs). In terms of value capture, Web3 is gradually showing the characteristics of "fat protocols, fat applications."

2. All values can be tokenized

2.1. Re-understanding Token

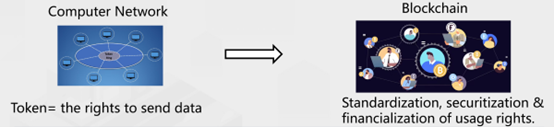

All digital assets are essentially tokenized values based on blockchain technology. Technically speaking, they are tokens, including both fungible and non-fungible types. How can we understand the important role of tokens in the Web3 new economy? As early as the 1960s, when computer systems were first introduced, as shown in Figure 3, tokens represented permission to access and use computer systems. As the usage-permission tokens gradually evolved from the internet era to the blockchain era, usage permission was further standardized, fractionalized, and financialized, becoming tokens in the Web3 new economy. Tokens are a system for extracting usage rights from digital products and services and capturing value.

Figure 3: Evolution of Token

In the Web3 new economy, all values can be tokenized. The basis of tokenization is the functions that are built into the blockchain, such as identity management, money and payment, asset registration, trading, and clearing and settlement. There are four main ways to tokenize. First, tokens represent usage rights. Second, NFTs represent proofs of identity, capability, behavior, workload, contribution, activity, and product and service, etc. Third, tokens represent off-chain values, such as central bank digital currencies, stablecoins, and tokenized green bonds. Fourth, tokens represent income rights, governance rights, or a combination of digital assets.

2.2. The Real Value of Tokens

Firstly, token issuance depends on a clearly defined algorithm model, where the key is to control the quantity and speed of issuance. The quantity limit and issuance discipline stipulated by the algorithm are the foundation of token consensus and trust mechanism, embodying the principle of "Code is Law".

Secondly, tokens represent usage rights. Only those who possess tokens of a certain blockchain network, system, or application have the right to use it.

Thirdly, token circulation. Users consume some tokens every time they use a certain blockchain network, system, or application. Therefore, token circulation follows a deflationary model as a whole. For example, in Ethereum, the daily gas fee consumption has exceeded the daily issuance of ETH in the network, which has an important role in grounding the value of Ethereum.

The fourth is the security attribute of Token. In some blockchain applications, often the founding team not only utilizes the functional use of tokens but also the security use of tokens. For example, the founding team usually promises to use a portion of the project's cash flow income to repurchase the tokens circulating on the market, essentially transferring a portion of economic rights to token holders.

The fifth is the governance attribute of Token. In some distributed communities or decentralized autonomous organizations (DAOs) within blockchain networks or systems, Token is often used to transfer a portion of governance rights. Tokens are credentials for voting rights, and token holders can participate in community voting, decision-making, governance, etc.

2.3. “Three-token Model” for the Web3 New Economy

Due to their global nature, blockchain base protocols only require a "one-token model" for their built-in value capture system, with BTC and ETH being typical representatives. The Web3 new economy will generate new currency markets, capital markets, and commodity markets, requiring the use of different types of tokens as value markers for economic activities, including utility tokens, security tokens, and non-fungible tokens (NFTs), representing usage rights, equity, and digital certificates, respectively. This is the "three-token model".

Utility tokens represent the right to use digital products and services. Only by holding the utility tokens issued by a network, system, or application can one have the right to use the relevant products and services. The more ecological applications and users there are, the greater the market demand for utility tokens. Utility tokens are also certificates for obtaining other rights. For example, a project team can lock an address holding a certain type of token as the target group and airdrop the project's governance tokens to that address. In practice, utility tokens can be given away as ecological points for free to incentivize users and launch the market. Utility tokens can be priced by secondary-market trading without financing activities such as "issuance, sales, and subscription." The value of utility tokens comes from: 1. permission to use the network; 2. payment for gas fees and commissions; 3. companies repurchasing with part of their profits; 4. certificates of governance rights in certain communities; 5. priority for receiving airdrops and joining whitelists. Utility tokens are unit of measurement for network effects.

The founding team and early investors play a crucial role from the initiation to the implementation phase of a project. At this stage, if there are only utility tokens, it is not enough to incentivize the founding team, and the return on investment is not attractive enough to attract early investors. Therefore, it is necessary to introduce security tokens, which represent equity granted to the project team and early investors. In terms of economic nature, security tokens are essentially not different from stocks. Security tokens are not listed on stock exchanges but enter virtual asset exchanges through Security Token Offerings (STOs). STOs are sold on global networks such as public blockchains and are on the same trading platform as utility tokens, bringing together users and investors and usually achieving higher valuation levels.

Non-fungible tokens (NFTs) play an important role in the authentication, permission, and proof of fully digital assets, and are the true "digital certificates." NFTs can tokenize ownership of assets, enhancing their liquidity in secondary markets. NFTs can record contribution, activity, and behavior of stakeholders in the Web3 economic system, which can serve as a basis for rewarding stakeholders. In short, NFTs can connect everything, including Web2 and Web3, the real world and the virtual world, offline and online, digital twins and digital natives, users and communities, and consumption and experience. The value of NFTs comes from "Play NFT to Earn" and "Play NFT to Own."

In general, the Web3 new economy is essentially a distributed network, where value is constantly generated, combined, transformed, circulated, and distributed. Utility tokens capture network value as usage rights in a distributed network. Some of the value is accumulated in enterprise nodes, and security tokens represent corporate equity. NFTs play the role of digital tokens in a distributed network.

3. Tokenomics

3.1. "Trinity" Methodology

In tokenomics, monetary policy, mechanism design, and financial engineering form a "trinity" relationship. The goal of monetary policy is to regulate token supply and demand, the goal of mechanism design is to achieve incentive compatibility, and the goal of financial engineering is to risk and return transformation.

Figure 4: "Trinity" Methodology of Tokenomics

All token economies are influenced at the macro level by the supply and demand of tokens, at the micro level by the incentive mechanisms of stakeholders and cannot do without financial engineering methods in the design of financial products and markets. The research goal of tokenomics can be summarized as follows: to stimulate the active participation of stakeholders in Web3's new economy activities through the rational design of token supply mechanisms, application scenarios, and related financial products and markets, thereby promoting the growth of token value.

2.2. Monetary Policy

2.2.1. The Impossible Trilemma of Tokenomics

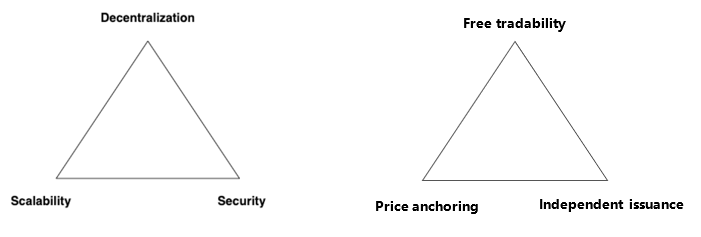

In the Web3 domain, innovation will mainly revolve around two "impossible trilemmas," as shown in Figure 5. The first is the "blockchain impossible trilemma," which refers to the fact that no blockchain network or system can achieve all three goals of decentralization, scalability, and security at the same time. The second is the "impossible trilemma of tokenomics," which refers to the fact that no token economic model can simultaneously achieve the goals of free tradability, price anchoring, and independent issuance. The "impossible trilemma of tokenomics" is the key to understanding the sustainability and intrinsic stability of token economic models. In a sense, the breakthrough of the "blockchain impossible trilemma" is the fundamental driving force behind the innovation of blockchain technologies, while the breakthrough of the "impossible trilemma of tokenomics" is the fundamental driving force behind the innovation of tokenomics.

Figure 5: Two ‘Trilemma’ in the Web3 Field

2.2.2. Separation of Asset Function and Money Function

In the Web3 new economy, the price of tokens is influenced by factors such as ecosystem development, secondary market liquidity, and investor sentiment, causing fluctuations. If tokens are used as payment tools for economic activities, price fluctuations may inhibit the development of economic activities. Token price fluctuations may also lead to inherent instability within the tokenomic model.

To ensure the stability of the Web3 economic system, it is necessary to separate the asset function from the money function when designing a tokenomic model. Tokens that represent the asset function represent the share of participants in the Web3 new economy, intending to capture the value brought by economic development. Tokens that perform the money function can isolate the impact of price fluctuations of the former type of tokens on economic activities, allowing participants to focus on economic activities. In certain stages of the development of the Web3 new economy, there will inevitably be a situation where token prices fall, which needs to be avoided to prevent irreversible damage to economic activities, community cohesion, and so on. This way, when the market fundamentals improve, token prices can be restored.

Tokenomic models need to embed stability mechanisms: during the phase of token price decline, the participation cost of economic activities decreases, the economic activity increases, and the token issuance and circulation speed also decrease. This provides strong support for token value and prevents the occurrence of a "death spiral".

2.2.3. Token Issuance and Circulation Mechanisms

Token issuance and circulation mechanisms have a crucial impact on the stability of the tokenomic model. In the real world, the growth rate of the money supply is generally equal to the sum of the GDP growth rate and the inflation rate. In the Web3 new economy, the effective supply and circulation speed of tokens need to adapt to the development needs of the Web3 new economy. The core issues include: first, the initial issuance quantity and speed; second, the issuance speed after the appearance of secondary market prices; third, the relationship between token prices and mainstream or related tokens (i.e., token exchange rate model), and its impact on the economic model; fourth, token recycle, redemption, buyback, destruction, and deposition in usage scenarios.

Several mechanisms can regulate the effective supply and circulation speed of tokens. Firstly, expanding the application scenarios of tokens so that some tokens are "locked" in application scenarios instead of being traded in the secondary market. Secondly, introducing a token-burning mechanism, such as automatically destroying the tokens that users pay in certain application scenarios. The token buyback mechanism is also very important, and the buyback speed can be non-linear or accelerated to achieve deflationary effects. Thirdly, the staking mechanism essentially regulates token liquidity across different periods. In the short term, staking will "freeze" a portion of tokens, but in the long term, these tokens will be released, and the staking yield will vary with the issuance of new tokens. If the fundamentals of the Web3 new economy can improve during the staking period, the liquidity of the tokens released in the long term can be absorbed.

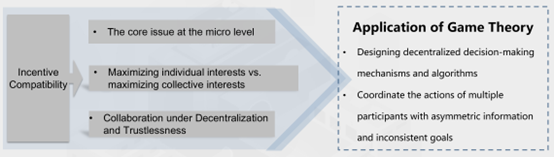

2.2.4. Mechanism Design

Every rational economic actor participates in market activities based on self-interest, but individual pursuits of self-interest may go against collective interests or affect the overall goals of society. If there is a mechanism design that can make each participant's pursuit of self-interest maximization coincide with the goal of maximizing collective interests, this mechanism design is incentive-compatible.

Figure 6: Core Principles of Token Mechanism Design

As shown in Figure 6, incentive compatibility is the core principle that tokenomic model designs must follow. Only by satisfying the incentive compatibility condition can collaboration be promoted in a decentralized and trustless environment, where the individual interest of participants aligns with the collective interests and prevent community fragmentation due to unfair incentives.

In the Web3 new economy, there are significant differences among participants in terms of psychological factors, cognitive biases, and behavioral tendencies. Therefore, achieving perfect incentive compatibility in mechanism design is difficult. It is imperative to design dynamic game mechanisms and algorithms to support decentralized decision making and coordinate the actions of multiple participants with asymmetric information and inconsistent goals.

In the "three-token model" of the Web3 new economy, mechanism design has significant practical value. Security tokens are subject to securities regulation and must meet securities regulatory requirements or exemption criteria in their issuance and trading. For example, the U.S. Securities and Exchange Commission (SEC) uses the Howey Test to determine whether digital assets have securities attributes. The Howey Test consists of four criteria: investment of money, in a common enterprise, with an expectation of profits primarily from the efforts of others. In the design and use of utility tokens, in addition to not touching on the four criteria of the Howey Test, it is best to distribute them for free in the form of ecological rewards. In this case, before the utility tokens enter the secondary market, their starting price cannot be determined based on past financing, but a Dutch auction can provide guidance for the starting price. Dutch auctions are conducted on the blockchain in an open, transparent, secure, and decentralized manner. Whether utility tokens can be listed on exchanges can also be decided by quadratic voting mechanisms.

2.2.5. Financial Engineering

Tokenomics uses financial engineering methods to transform risk and return, with 5 main objectives: First, to support resource allocation across time and space; Second, to design corresponding financial products according to different scenarios and user needs; Third, liquidity management, especially to reduce liquidity costs; Fourth, asset pricing; Fifth, risk management.

4. Web3 New Economy's Surpassing of the Internet Economy

In terms of economic systems, economic organizations, financial systems, value creation and distribution rules, stakeholders, business models, decentralized decision-making mechanisms, and value capture, the Web3 new economy will surpass the Internet economy.

4.1. Economic System

From the perspective of property rights and profit distribution systems, economic models can be divided into the "Main Street Model" of the industrial economy, the "Silicon Valley Model" of the Internet economy, and the "Shared Capital Model" of the Web3 new economy.

The "Main Street Model" ha a centralized property rights structure and capital profits were enjoyed individually, resulting in the emergence of numerous big capitalists in this stage.

In the "Silicon Valley Model," property rights are decentralized, and the scope of capital is expanded. Capital is no longer limited to the amount of funds available, but knowledge has also become an important form of capital. Entrepreneurs attract venture capital with business plans and realize the monetization of knowledge. The "Silicon Valley Model" is no longer a monopolistic capital and exclusive profit distribution model but instead, through shareholder capitalism, ownership and profit can be shared.

The "Shared Capital Model" is a more advanced model than the "Silicon Valley Model." All stakeholders can share all the value created by economic or business organizations.

4.2. Economic Organization

Under the "Main Street Model" and "Silicon Valley Model," economic organizations are usually centralized companies. When companies first emerged, they mainly adopted top-down decision-making mechanisms and had a U-shaped structure. With the diversification and globalization of corporate economic activities, business units and regional units gradually emerged, and the power of the group headquarters was gradually decentralized, presenting an M-shaped structure in terms of the overall architecture.

The "Shared Capital Model" essentially inherits the M-shaped structure of corporate organizations and gradually forms a distributed autonomous organization (DAO) form, distributing organizational rights or benefits to stakeholders through tokenization.

4.3. Financial System

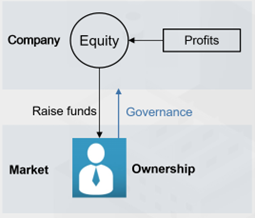

The Web3 new economy may have two sets of capital market systems. The first one is shareholder capitalism based on industrial and internet economies. The financial activities of shareholder capitalism are shown in Figure 7. Companies raise funds from the market through equity financing, and equity represents the standardization and financialization of ownership of the company. Holding equity entitles one to receive the company's profit-sharing and governance rights.

Figure 7: The financial activities of shareholder capitalism

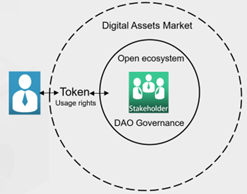

The second type is stakeholder capitalism based on the Web3 new economy. Shareholder capitalism emphasizes ownership and uses equity as incentives to encourage the establishment of new companies and businesses. Stakeholder capitalism emphasizes usage rights and uses tokens to represent stakeholders' share of rights. The financial activity form of stakeholder capitalism is shown in Figure 8. Tokens are standardized, shareable, and financialized usage rights in the open ecosystem. Holding tokens means having the right to participate in the governance of the open ecosystem and the right to use digital products or services in the open ecosystem.

Figure 8: The Financial Activity Form of Stakeholder Capitalism

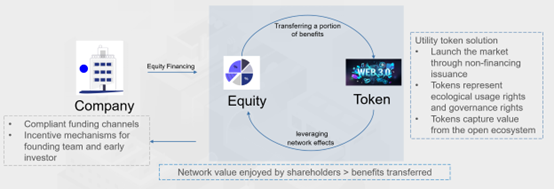

Shareholder capitalism and stakeholder capitalism can be integrated. As shown in Figure 9, there will be some corporate nodes in the Web3 new economy. Corporate equity is not only a compliant financing channel but also provides incentive mechanisms for the founding team and early investors. Corporate shareholders can transfer part of their interests to utility tokens in the corporate ecosystem, and utility tokens can leverage the network effect to promote the development of the corporate ecosystem. As long as the network value enjoyed by shareholders is greater than the benefits transferred, both shareholders and utility token holders will benefit. Utility tokens can be used to launch the market through non-financing issuance, representing the right to use and govern the ecosystem, and capturing value from the open ecosystem.

Figure 9: Integration of Shareholder Capitalism and Stakeholder Capitalism

4.4. Law of Value Creation

The Industrial economy pursues the maximization of company value, the Internet economy pursues the maximization of shareholder interests, while Web3 new economy pursues the maximization of organizational interests.

4.5. Law of Value Distribution

The Industrial economy has high fixed costs and increasing marginal costs. Therefore, the pricing model of the Industrial economy is basically cost-based pricing and there can be no free model.

For the Internet economy, the free model dominates, and the saying goes "The wool comes from the sheep, but it is the dog that pays the bill." The reason why it is free is that the Internet economy has the characteristics of high fixed costs, but decreasing marginal costs that tend to zero. However, internet products that appear to be free may actually be more expensive than manufacturing industry products. This has also created some internet companies with a market value of over one trillion dollars.

The value distribution in the Web3 new economy follows a fair, just, and transparent distribution mechanism, allowing stakeholders to share profits.

4.6. Stakeholders

The business model of the Web3 new economy is described as "Player to Earn", where "Player" refers to stakeholders, including developers, creators, contributors, consumers, investors, etc. All participants will be players in Web3.

4.7. Basic Business Model

The classic business model of the Web3 new economy should be "Play NFT" and "Earn Token". As mentioned earlier, NFT is a proof of contribution, and Token is a standardized and shareable right to use. Usage rights can be traded on the secondary market to monetize the value of contributions.

4.8. Decentralized Decision-Making Mechanism

The decision-making mechanism of the Web3 new economy is decentralized. The purpose of decentralization is not to resist censorship, reject compliance or refuse regulation, but to introduce a fairer decision-making mechanism through digital technology. In the balance between efficiency and fairness, the Web3 new economy's business scenarios need to find a suitable balance point.

4.9. Value Capture

The value capture of the Internet economy is usually referred to as "thin protocol, fat application," while the Web3 new economy is "fat protocol, fat application." The difference between fat and thin lies in the ability to capture value.

The core of the Internet is the TCP/IP model, which allocates network addresses through the IP protocol and relies on the TCP protocol for communication. The Internet protocol lacks a value capture system, which makes it unfriendly to protocol layer developers in terms of economic incentives. The Internet application layer relies on "surveillance capitalism" to capture a lot of value from user data and attention (including users passively watching advertisements pushed by Internet platforms).

The Web3 new economy's underlying protocol stack includes money and value systems, which can create value at the protocol layer. In the application layer, the Web3 new economy will combine many digital technologies, and the space for value creation will be no less than that of the Internet. Both the Web3 protocol layer and the application layer are based on token-based distributed economies, essentially market networks where participants trade directly, and economic value is shared by stakeholders.

The commercial value of the distributed economy is not reflected in shareholder equity but is inherent in the market network and ultimately reflected in token value, which is positively correlated with the magnitude of economic activities. The token-based distributed economy has strong network effects. The increase in user base leads to a higher increase in the value of the distributed economy (n^2 order of magnitude) compared to centralized businesses (linear order of magnitude).

to download the pdf.