HashKey Weekly Round-Up | 25 November 2022

I. Dr. Xiao: From Vitalik to Devcon: how Shanghai came into the fold of the Ethereum story

"I received a WeChat friend request... and that was how I finally got in touch with Vitalik, Founder of Ethereum. Vitalik and I would often meet to talk about blockchain and Ethereum. One morning in 2015, Vitalik arrived at our headquarters looking slightly tired; it looked like he did not rest well the night before...".

Dr. Xiao Feng, Chairman of the HashKey Group, played an essential role in the development of Ethereum during its early days. Dr. Xiao, also the Chairman and CEO of Wanxiang Blockchain, first met then 20-year-old Vitalik Buterin in 2015. He was impressed with Vitalik's ability to communicate and write in Chinese. Later, Dr. Xiao and Wanxiang Blockchain would be heavily involved in growing the Ethereum community, including hosting various blockchain summits in Shanghai which would later be known as the "Shanghai International Blockchain Week".

Read this "untold story" by Dr. Xiao Feng on how the city of Shanghai came into the fold of the Ethereum story.

II. EPotter: Getting your ETH to work for you

Do you have some idle digital assets such as ETH? How about letting these "work" for you? But are you concerned that your ETH will be locked up and that you will not be able to access them when you need liquidity?

EPotter liquid staking overcomes this.

EPotter by HashKey Group is a trusted institutional-grade solution for liquid Proof-of-Stake validation. Owning the transferrable epETH token (an ERC-20 liquid representation of ownership of the underlying locked ETH and any rewards earned from staking) could allow epETH tokenholders to earn validation rewards while maintaining the flexibility to be able to trade it on secondary markets if so desired.

Learn more about the mechanics of liquid staking and how EPotter works in this introduction video.

III. HashKey's Executive President speaks to The Asset

Michel Lee, Executive President of HashKey Group, recently spoke to The Asset, on Hash Blockchain Limited, a member of HashKey Group, receiving its Type 1 and 7 licences from the Securities and Futures Commission of Hong Kong.

Michel says, "I hope that regulation would basically make it easier for people to participate [in the virtual assets space], which is facing a hindrance up to now." He added, "The overall market globally is going to be obviously a bit challenging given the macroeconomic environment, but it's actually good for the ecosystem because people are now much more focused on building proper projects to market rather than short-term speculation."

IV. HashKey joins forces with HKUST to bring immersive Web3 experience to college campus

HashKey Group is a proud partner of HKUST's flagship Web3 Carnival, organised by HKUST Web 3.0 Labs to commemorate the university's 30th anniversary.

Leo Li, Head of HashQuark (HashKey's staking-as-a-service provider) gave a keynote speech at the Carnival on November 8, where he introduced how proof-of-stake validation works, as well as how decentralised identifiers form an essential infrastructure of the Web3 ecosystem.

HashKey DID and the HKUST Crypto-FinTech Lab also jointly designed and minted a limited-edition On-Chain Soul Token (OST) NFT to recognise The Hong Kong University of Science and Technology's commitment to empowering innovation and creativity.

The HashQuark team also gave an in-person demo session for students on how they could create their own unique Web3 passport using the HashKey DID application. You can create your own Web3 digital identifier as well at www.hashkey.id !

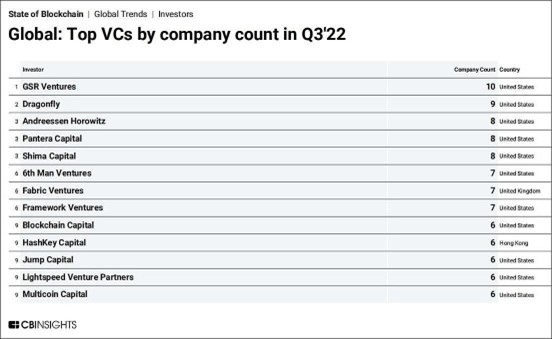

V. HashKey Capital named among top 10 crypto VCs

HashKey Capital, HashKey's venture capital and asset management arm, was listed by CB Insights in their latest State of Blockchain report as one of the Top 10 crypto VCs in the third quarter of 2022.

Also on the list include other industry heavyweights such as GSR Ventures, Dragonfly, Andreessen Horowitz, Pantera Capital, Jump Capital and Multicoin Capital.

Let the BUIDLing continue!

VI. Key Weekly Data

A. Market Data

(as of 24 November 2022)

• Total market value: US$836 billion (Source: CoinMarketCap)

• Total exchange volume of Bitcoin and Ethereum (7DMA): Bitcoin - US$6.89 billion; Ether - US$1.97 billion (Source: The Block Research)

• DEX 7-day growth: -33% compared to last week (US$14 billion) (Source: Dune Analytics)

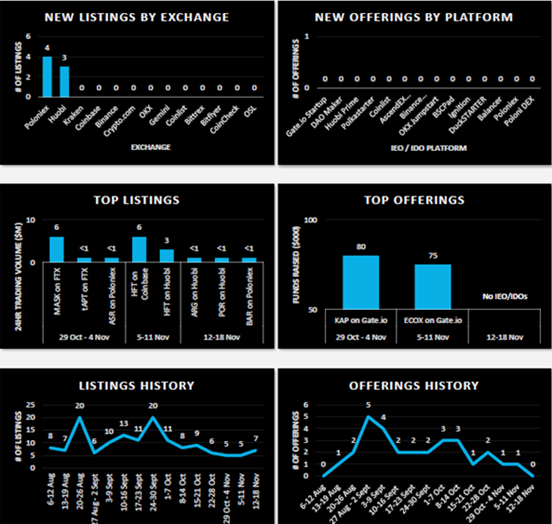

B. New Token Listings and Offerings (12 November 2022 - 18 November 2022)

(Source: HashKey Group Ecosystems Dept.)

• A total of 7 token listings on selected centralised exchange platforms (vs. 5 last week)

• None of these listings recorded any significant trading volume on the day of its listing.

• There were no IEO/ IDOs on the selected CEXes and DEXes (vs. 1 last week)