HashKey Weekly Round-Up | 16 December 2022

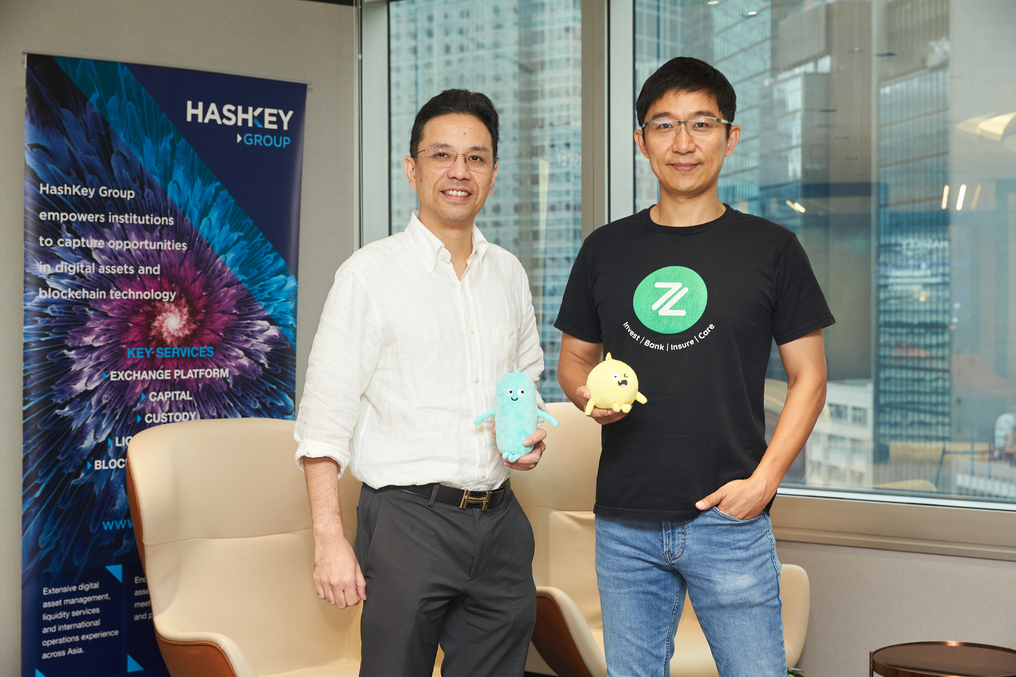

I. HashKey Group announces new partnership with ZA International to bolster FinTech innovation in Asia

HashKey Group has this week announced another strategic partnership, this time with ZA International, one of the leading FinTech unicorns and the only tech company in Hong Kong to hold licences for virtual banking and digital-only insurance.

Both firms will pool together their unique resources, expertise and technology prowess to empower and turbocharge FinTech and Web3 innovation in Asia as well as realise new investment opportunities in the blockchain ecosystem.

Wayne Xu, President of ZA International, commented, "The digital asset industry looks set to flourish across Asia, while the Hong Kong government has also laid out its vision to be a global virtual asset hub. We look forward to joining hands with HashKey to unleash the huge potential of FinTech."

Michel Lee, HashKey's Executive President, said, "ZA International brings years of expertise and know-how in technology and FinTech, which complement well with HashKey's products and track record in infrastructure building."

Over the past month, HashKey also formalised collaborations with SEBA Bank to accelerate institutional adoption of virtual assets in Hong Kong and Switzerland, as well as with Alibaba Cloud and PlatON.

II. 2022 DeFi Ecosystem Landscape Report

Get the lowdown on everything that happened in DeFi (decentralised finance) in 2022 in this ecosystem landscape report by the HashKey Capital research team.

From user growth rate to the derivatives market, from institutional adoption to on-chain DeFi activities, this report gives a comprehensive overview and analysis of the performance of DeFi throughout 2022. Some highlights and notable findings from the report include:

• Venture capital continues to fuel the growth of DeFi protocols. In H1 2022 alone, VC has invested over US$14 billion into 725 crypto projects (many of those are DeFi). So far in 2022 alone, HashKey Capital has invested in 7 DeFi-related projects.

• Ethereum continues to be the dominant chain in DeFi, being responsible for around 58% of all DeFi activities.

• Q3 saw the rise of uncollateralised lending, with the TVL of this sector growing from US$26 million in July to US$76 million in October.

• Despite the bear market, the options and derivatives market seem to be thriving, with platforms like GMX and dYdX gaining strong popularity.

III. Decentralised Identifiers: The Key to Realising Web 3.0

Less than a week after we shared that HashKey DID had recorded over 900,000 registered users, the decentralised protocol has now hit the 1 million mark!

For the uninitiated, DID stands for "decentralised identifier". You can think of it as a blockchain-based Web 3.0 identity system. One of the drawbacks of current centralised identity management systems is that user information is repeatedly collected by these platforms and shared with other applications. As preposterous as it may sound, users actually have no or very limited control over their personal information and data. This is where DID comes into play.

Compared with the traditional identifiers used by centralised entities such as Google and Facebook, DID is designed in a way where it is decoupled from registries and government-controlled authorities. DID enables its users to take back control over their personal data without requiring permission from any other parties.

Learn more about HashKey DID's use cases and how DIDs complement Web3 in this intro feature piece.

IV. Michel Lee speaks with RTHK

On the back of HashKey's recent virtual asset exchange licence approvals, Michel Lee, HashKey Group's Executive President, was recently featured on RTHK's news and radio shows, where he commented on Hong Kong's virtual asset regulatory framework and the future of the city as a digital asset hub.

The section about virtual assets begins at 10:15, and Michel's interview starts at 11:30.

V. Key Weekly Data

Market Data (as of 15 December 2022)

• Total market value: US$849 billion (Source: CoinMarketCap)

• Total exchange volume of Bitcoin and Ethereum (7DMA): Bitcoin - US$7.47 billion; Ether - US$1.59 billion (Source: The Block Research)

• DEX 7-day growth: +21% compared to last week (US$8 billion) (Source: Dune Analytics)

Written by: Jason Li (Marketing and Client Strategy Manager)