veToken Model and its Impact

Part 1: The veToken model and its functionality

The veToken model marks an important development for the token economy in the world of digital assets. Originating from Curve(veCRV), the veToken model was imitated by other DeFi protocols and has undergone many periods of transformations, such as xToken and stToken. The essence of the veToken model is having its native token locked up and voting rights empowerment, deriving some strategies to achieve the maximum benefit. For example, Curve’s native token CRV has three functions: voting, staking and boosting yield, which all require CRV locked in the form of veCRV, which has become the foundation of the entire system.

These veToken initiatives can serve two purposes, one is for maximizing reward, specifically to obtain protocol earnings, and the other is for establishment, mainly to achieve the best results for new-launching projects. At present, although various major ecosystems are following the veToken models, there are also some doubts regarding its utilities, especially after the LUNA incident, despite the fact that the veToken is linked to stablecoin swap protocols and not the algorithmic stablecoin itself. We have sorted out and analysed this model’s historical development and ecosystem relevance here.

Part 2: Value creation of veToken

The value of veToken comes mainly from governance rights. “ve” stands for “Voter escrowed”. Many native tokens already have built-in voting rights (which is part of community governance), so why create another token (can be seen as derivatives) to replace native token for governance? Here are some flaws of the traditional native token model: :

• The liquidity of native tokens is difficult to control ( dump and pump may happen)

• Governance easy to gaming (e.g. instantly large amount purchase)

• People are focused on making short-term gains at the expense of long-term interests

• All of the above may lead to division in the community

The main mechanism of veToken is based on long-term staking, such as the 4-year Curve lockup, which is also the prevailing mode of the current veToken model. By locking up positions, the tokens’ economic interests and voting rights are effectively stratified. The primitive economic value of the protocols remains with the native token holder, and the voting rights are assumed by the veToken, which can also bring secondary income such as fees. The characteristics of veToken are as follows:

• Non-transferable and non-tradable

• The intrinsic economic value is zero

The value proposition of VeToken is:

· Lock-in reduces the liquidity of native tokens so reduce selling pressure

· Locked voting rights align the interests of the community (malicious behaviour will lead to a decline in the value of native tokens)

· The compensation for locking comes from a boost to the mining bonus

How can veToken achieve this? Here’s what we think:

· The protocol should be for mass adoption (huge user base or already infrastructure)

· The economics of protocol liquidity mining reward need to be great (not to be high yield but sizeable) and relatively stable

· The non-economic value of governance also must be obtainable

Curve satisfies such conditions by:

· Being a stablecoin exchange that is necessary for the DeFi miners/users

· Serving as a steady stream of revenue, even in bear markets

· Providing established pools for all kinds of stablecoins, which we will discuss in detail (USDM attack event).

Part 3: Playbook on top of veToken

If that veToken is just for long term lockup, it will look exactly like staking, but due to the functions that veToken can bring, it could be more creative, thus the veToken model playbook is regarded as more interesting and dramatic.

3.1 Convex model — governance and yield hunting

Since there is a long lock-up period, even with yield boosting, capital efficiency should also be addressed. The problem is how should the liquidity be released. With DeFi, it is not hard to achieve, and this is what Convex has done with the introduction of Curve wars.

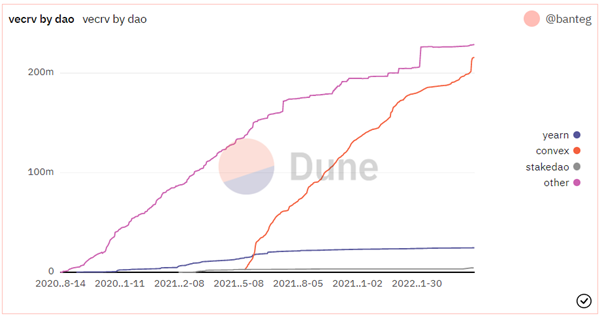

· The Curve Wars is a race between DeFi protocols that are increasingly locking CRV positions in order to gain higher pool rewards. Since veCRV can generate higher boost rewards, large protocols have been stockpiling CRVs to earn higher rewards and voting rights.

· Convex emerged as the winner of the Wars. It was a deal specifically designed to optimise the benefits of Curve. Previously, CRV holders could only participate in governance by changing Curve to veCRV, but with Convex, users can permanently deposit CRV on the Convex exchange for an equal amount of liquid cvxCRV tokens. Holders of cvxCRV can receive rewards not only from Curve, but also from CVX (Convex token). And all governance will be vested in Convex.

· The success of Convex has brought all kinds of DAOs swarming over it, rather than the Curve protocol, since control of Convex was equivalent to the control of Curve (like having control of a holding company). Various DAOs began to develop the mode of bribery at Convex for their own benefits, hoping that users could help them accomplish various objectives.

The significance of Curve is to provide liquidity to many new stablecoin pools (like USDM/DAI) and such liquidity is rewarded by the pool. Therefore, the newborn protocols will have the motivation to buy more CVX to increase its own liquidity and thus resulting in larger USDX/ high liquid stablecoin pairs. USDM changed worthless USDM into DAI after setting up the pool, exposing the risk that VeToken does not protect protocols from such attacks. CVX has instead become an accomplice to the protocol attack after the aggregation of governance power.

3.2 Bribe model

There are two prevailing protocols for bribe: bribe.crv.finance (for veCRV holders) and Votium (for CVX holders). They perform like a voting agent by collecting users votes and giving out bribe tokens on behalf of projects.

Since votes are concentrated in locked tokens, it becomes a profitable business to gain CVX user support, as Votium does. The users lock their CVX to the Convex platform to obtain the vlCVX token. Votium provides users with the opportunity to delegate or vote according to how many vlCVX users there are, and a certain amount of bonus.

The agency and incentive modes are relatively clear, and both vlCVX holders and vote purchasers can benefit directly. Votium doesn’t charge a cash withdrawal fee and has only a fraction of the operating costs, so users (holders and vote buyers) don’t have to pay much to use it.

3.3 How Votium works?

CVX are locked on Convex for 16 weeks. To start receiving Votium rewards, users have two options:

1. User can delegate to Votium via the Delegate function. Votium will vote for users in several incentive pools, and user can receive incentives without any additional work. During the delegate process (which is not mandatory), users can still manually vote for a single pool if he/she wants to receive specific incentives for only one token.

2. Vote manually: after the award of a live proposal has been deposited in Votium, some rewards are shown. To get a share of the incentive, users need to vote on this proposal.

Curve and Convex mainly channel liquidity flows rather than manage risk, while bribery has the potential to undermine protocols that require active risk management to work properly. If lending protocols like Aave and Compound is converted to a veModel that allows the bribery mode, it is possible for an low-quality asset to become collateral on the platform through accumulation of veTokens. Low-quality collateral would drive the lending market into a liquidity crunch, as can be seen in the TraDefi markets, which in turn will deter user participation.

3.4 veNFT-combined veToten and NFT

We also see other protocols adopting veToken models, among which veNFT is an innovative worth discussing. Even though its founder, Andre Cronje, has since exited from DeFi, veNFT has still set up some examples that we can learn from a tokenomics perspective.

Early this year, well-known blockchain developer Andre Cronje (AC) announced a new ve (3,3) project called Solidly on the Fantom chain; the core governance token on Solidly is named veNFT and is used to be the largest protocol assigned by veNFT to TVL on Fantom. ve (3,3) does not allocate fees in the form of native tokens or stablecoins, but instead allocates “fee assets” that continuously pass on the value of fees, thus reducing the selling pressure on native tokens.

The distribution of veNFT was free, so it was pivotal to consistently secure airdrops of these tokens. In early January a TVL war happened on Fantom, driving up the total value locked up on Fantom. Among them, veDAO won the second place in TVL in a short period of time by bribing the token $WEVE, thus obtaining a large amount of veNFT.

AC’s design is very community-driven-friendly, because all tokens are allocated to the community, a very rare case for such a large project. However, we also need to see that the ve (3,3) model, in term of locking a large amount of liquidity, will also greatly increase the expectations of the community. After all, liquidity is real money, and the community members would exchange that for decent products and sizeable income to meet their needs. Thus, not all projects are suitable for ve, as locking liquidity comes at a cost.

Like Sushi/Curve, the fee collected goes to veNFT holders. But there are a few differences:

· The pool with the highest fee gets the highest token reward

· veNFT holders can determine the distribution of token rewards

· veNFT holders will only receive rewards from the pools voted for

That would incentivize fees rather than liquidity. And with the allocation of tokens and pool rewards aligned, participants can voluntarily maintain the protocol and make improvements.

Emissions are also important: If no one is locked for veTokens, the weekly emission is maximum as of total decay. If the VE is locked at 100%, the weekly emission is 0, which means no dilution. veNFT can be treated as plain NFT, so one address can have multiple lock positions, and veNFT can be traded and borrowed. This design which does not encompass pure lock-in greatly improves capital efficiency.

Although Solidly is still running, the crypto community has paid less attention to the project due to the exit of its Founder and extremely low market sentiment.

Part 4: VeToken criticisms

There are also some criticisms from the community on VeToken model:

· Segregation of governance and economic incentives: The separation of voting rights and economic gains has led to a majority of users neglecting the importance of governance, leading to a heavier centralization of governance that can increase the probability of bad behaviour by big players.

· Bribery may lead to credit risk: Bribery put protocols at risk when engaging in lending/borrowing, such as MakerDAO, which may allow some toxic assets to become collateral, thus harming the bi-party of lending game, but that doesn’t matter a lot to users who are looking for short-term financial incentives.

· On the contrary, increasing difficulty to defend against governance attack: The power of locking token to defend against governance attacks is not going one-way. If the mass locking party decides to behave in an evil manner, then how does the protocol defend? This adds significantly to the cost of protection protocols (e.g., the need to lock up a large number of tokens at once, like Curve). Defenders may also hurt the value of the tokens when they exit from the protocol.

Part 5: Outlook

VeToken can described as a more prominent type of DeFi model innovation, but here at HashKey Capital wethink that VeToken model could only exist in a few leading DeFi protocolsand not all. In fact, as we stated before, veToken requires a very strong underlying protocol with massive traffic and steady tokens as compensation.

Stablecoin itself will also be questioned after the Luna/UST crash, and people may shift their focus from algorithmic stablecoins to the more stable reserve-backed stablecoins, like USDC, which have better stability mechanisms. It is true that we are currently in a bear market, and the value of every asset is plummeting, so the stablecoin-based veToken model doesn’t seem very attractive to users, considering its long locking time and (maybe) worthless derivatives. When the next bull cycle come, we assume the veToken model will still be tested and time will tell whether it can become a pillar for stablecoin swap protocols in a more conservative/stable way.

Stablecoin itself will also be questioned after the Luna/UST crash, and people may shift their focus from algorithmic stablecoins to the more stable reserve-backed stablecoins, like USDC, which have better stability mechanisms. It is true that we are currently in a bear market, and the value of every asset is plummeting, so the stablecoin-based veToken model doesn’t seem very attractive to users, considering its long locking time and (maybe) worthless derivatives. When the next bull cycle come, we assume the veToken model will still be tested and time will tell whether it can become a pillar for stablecoin swap protocols in a more conservative/stable way.

About HashKey Capital

HashKey Capital, HashKey Group’s venture capital arm, is an institutional asset manager investing exclusively in blockchain technology, digital assets and crypto-financial infrastructures. It provides accredited investors and professional investors with secure access and diversified exposure to digital assets. HashKey Capital combines the agility and independent risk-taking traditionally found in the best venture firms, while offering differentiated access to the network of relationships found in one of the largest industrial and financial conglomerates in the world.

hashkey.capital | ir@hashkey.com

Notes and Disclaimer

Views, information and opinions expressed in this material are those of the individuals involved and do not necessarily represent that of the HashKey Group (including any of its affiliates). While we make every effort to ensure that the information we are sharing is accurate, we welcome any comments, suggestions, or correction of errors.

This material should not be considered as an offer or solicitation to sell, buy or subscribe to any financial instruments or product, securities or any derivative instrument, or any other rights pertaining thereto. We are not acting as a financial adviser, consultant or fiduciary to you with respect to any information provided in this material. We do not express any opinion or recommendation whatsoever as to any strategies, products or any other information presented in the materials.

Any decision made by a party after accessing to this material shall be on the basis of its own research and not be influenced or based on any view expressed in this material or otherwise. This material does not address all risks. This material does not constitute investment advice or a recommendation and has been prepared without regard to individual financial circumstances, objectives or particular needs of you. You should seek their own financial, tax, legal, regulatory and other advice regarding the appropriateness or otherwise of investing in any investments and/or pursuing any investment strategies. The HashKey Group does not express any opinion as to the present or future value or price of any instruments referred to in this material.

By accessing this material, you acknowledge that the HashKey Group makes no warranty, guarantee, or representation as to the accuracy or sufficiency of the information featured in this material. The information, opinions, and recommendations presented in this material are for general information only and any reliance on the information provided in this material is done at your own risk. This material should not be considered professional advice. Moreover, the HashKey Group makes no warranty that this material, or the medium that makes it available, is free of viruses, worms, or other elements or codes that manifest contaminating or destructive properties.

By accessing this material, you acknowledge that the entire contents and design of this material, are the property of the HashKey Group, or used by the HashKey Group with permission, and are protected under applicable copyright and trademark laws. Except as otherwise provided herein, users of this material may save and use information contained in this material only for personal or other non-commercial, educational purposes. No other use, including, without limitation, reproduction, retransmission or editing, of this material may be made without the prior written permission of the HashKey Group.

Unless specifically stated otherwise, the HashKey Group does not endorse, approve, recommend, or certify any information, product, process, service, or organisation presented or mentioned in this material, and information from this material should not be referenced in any way to imply such approval or endorsement. The third party materials or content of any third party site referenced in this material do not necessarily reflect the opinions, standards or policies of the HashKey Group. The HashKey Group assumes no responsibility or liability for the accuracy or completeness of the content contained in third party materials or on third party sites referenced in this material or the compliance with applicable laws of such materials and/or links referenced herein.

The HashKey Group expressly disclaims any and all liability or responsibility for any direct, indirect, incidental, special, consequential or other damages arising out of any individual’s use of, reference to, reliance on, or inability to use, this material or the information presented in this material.