Cross-Chain Bridges: Transfer Crypto Between Blockchains

Cross-Chain Bridges: Transfer Crypto Between Blockchains

What are cross-chain bridges? How does a cross-chain bridge work? We have seen the emergence of multiple blockchain networks. It is therefore easy for every cryptocurrency user to come across the need of transferring tokens between blockchains. Say, you may move crypto assets from blockchain “A” to blockchain “B” to pursue higher rewards. The common way would be to use cross-chain bridges to “bridge” your tokens to another chain. Cross-chain bridges and other solutions are gaining steam as we move toward a multi-chain future. Here we will attempt to introduce the popular cross-chain bridges, as well as other cross-chain solutions.

What are Cross-Chain Bridges?

At a high level, a cross-chain is a (virtual) link that enables the transfer of data and value between independent blockchains.

To give more context, blockchain has an inherent issue of cross-chain communications. As each blockchain has its own set of rules and mechanism by design, they generally lack the ability to communicate with each other. For example, you can’t simply interact with a DeFi platform on Ethereum using Bitcoin.

“Each blockchain as a country” illustrated in a meme published in 2021. Source: stakefish.

You may think of blockchain networks as different countries. And “cross-chain” actions work like cross-border travelling in a way that it involves procedures, processing time and cost. As their names suggest, cross-chain solutions like blockchain bridges serve as the infrastructure connecting between two blockchain “countries”.

Basically, cross-chain solutions enables users to transfer crypto from one blockchain to another. They also facilitate the use of decentralised applications (dApps) on other blockchains.

Why we need Cross-Chain?

Every blockchain is providing different offerings to lure users to join and stay in their “country”.If you want to take advantage of features and applications on another blockchain, you need to move your tokens to there. Think of it like exchanging your Hong Kong dollar bill for Japanese Yen bill before you are going on an onsen trip in Japan.

For example, network fees on the Ethereum blockchain can be deterring for users. Therefore, offering lower fees and faster transaction times have become key selling points of several alternative blockchains. Crypto users may find this attractive to bridge tokens to a cheaper chain and enjoy lower fees in future transactions.

Another major demand comes from DeFi yield seekers. As a crypto user, you might have heard of DeFi yield farming-a way to generate rewards on your idle tokens. The rewards are different across DeFi platforms and different blockchains. Chasing higher rewards has been a major driver for moving tokens between blockchains.

How large is the cross-chain demand in the blockchain space? As of December 31, 2022, there was over US$7.7 billion of digital assets flowing through cross-chain bridges. Cross-chain technology has become the spotlight in the market as we move towards a multi-chain future.

4 Major Types of Cross-Chain Bridges

Cross-chain bridges are links between different independent blockchains to enable cross-chain transfers. Here, we will introduce the four most popular types of cross-chain bridges and how they work.

Cross-Chain Bridge: Transfer Crypto Between Two Blockchains

One common type of cross-chain bridges is the chain-specific bridges. The sole purpose of chain-specific bridges is to facilitate the transfer of crypto between a specific set of blockchains. The operation is usually simple: It basically locks the tokens on your source chain and then mint synthetic tokens on your destination chain.

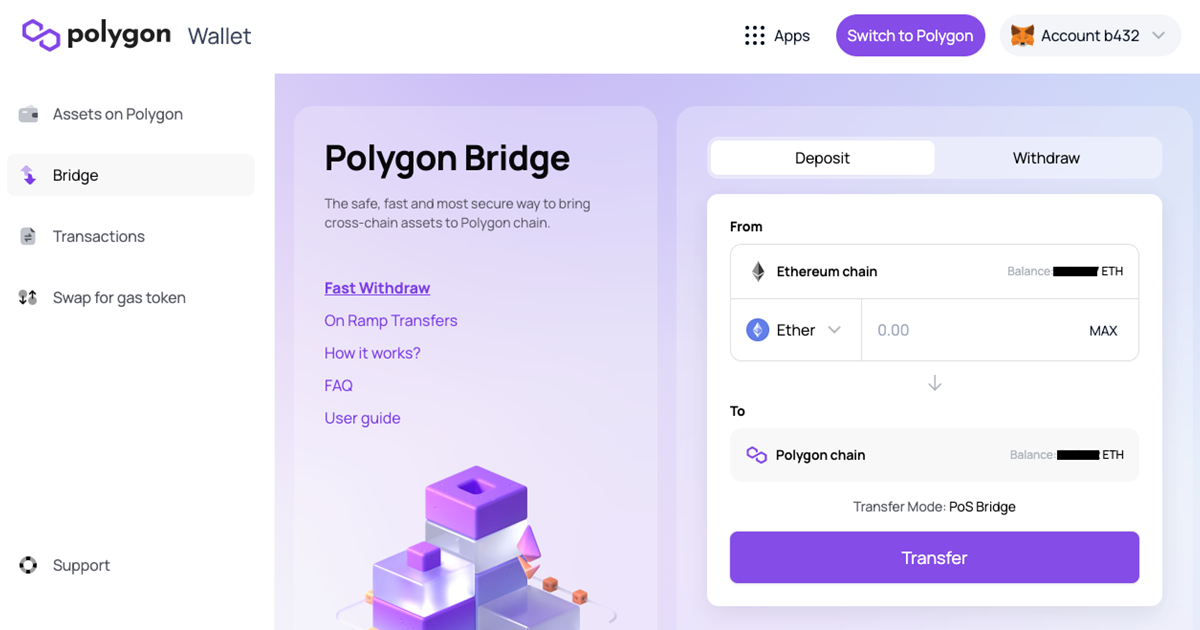

One example is the Polygon bridge that “transfers” tokens from Ethereum to Polygon, a Layer-2 network. Take bridging stablecoin USDC from Ethereum to Polygon as an example. On the Polygon Bridge portal, you can select USDC on Ethereum in your wallet, sign and approve the transaction. After you deposit your USDC, the bridge locks the USDC in a smart contract on Ethereum. After receiving a proof that the USDC is locked, the bridge mints an equal amount of Polygon USDC. You will receive Polygon USDC in your wallet and can use that on different dApps on Polygon.

Polygon Bridge allowing users to move assets from Ethereum to Polygon and vice versa. Source: ConsenSys.

Meanwhile, the bridge locks your Ethereum USDC in a smart contract. You must send the Polygon USDC to the bridge again when you want to move your funds back to Ethereum. In this redemption process, the bridge will burn your Polygon USDC to mint the equal amount of Ethereum USDC.

What are Wrapped Tokens?

Wrapped tokens are tokens that help move assets across blockchains. They are backed 1:1 by their underlying asset.

For example, you would like to use your Bitcoin (BTC) to generate rewards via a DeFi platform on Ethereum. Instead of selling your Bitcoin for other coins, you can convert your Bitcoin to Wrapped Bitcoin (wBTC). wBTC is an ERC-20 token compatible with Ethereum, and every wBTC represents the same value as a Bitcoin by design. You can use your wBTC to access decentralised exchanges (DEXes) and DeFi platforms on the Ethereum blockchain.

To receive wBTC, a user requests tokens from a merchant. After verifying the user’s identity, the merchant will receive the Bitcoin from the user and initiate a wBTC minting process with the custodian. The merchant will lock up the Bitcoin, and then receive an equal amount of wBTC from the custodian (minting). They will then transfer the wBTC to the user. To redeem the original underlying Bitcoin, it must go through a “burning” process where the custodian destroys the wBTC and unlocks the original Bitcoin.

WBTC are one of the most popular wrapped tokens, along with renBTC and wETH (Wrapped ETH). By the end of January 2023, there are over 176,000 wBTC (approximately US$4 billion worth) circulating in the market.

Cross-Chain Bridge: DeFi Applications

Instead of facilitating only two blockchains, there are now cross-chain decentralised finance (DeFi) applications offering access to multiple blockchains. Purpose of these platforms is to let users enjoy asset liquidity across various chains- all within the same application.

THORChain, Multichain and Synapse are some of the DeFi platforms that facilitates cross-chain transfers. They support asset swapping across various chains including Bitcoin, Ethereum, Binance Smart Chain (BSC) and more.

Many of the cross-chain DeFi platforms are using a “liquidity pool” structure to facilitate the movement of tokens across blockchains.

To explain how it works in a non-technical way: the cross-chain DeFi platform creates pools on both chains to facilitate the transfers.

Let’s say a user wants to swap a BTC on the Bitcoin blockchain to ETH on the Ethereum chain. The cross-chain DeFi platform would conduct two trades on the liquidity pools on both chains respectively. After depositing a Bitcoin, the user will receive the ETH token-sent from the liquidity pool on the Ethereum chain. From the user’s point of view, it works like a simple, usual swap within a single platform.

Cross-Chain Bridge: Transfer Crypto Across Multiple Chains

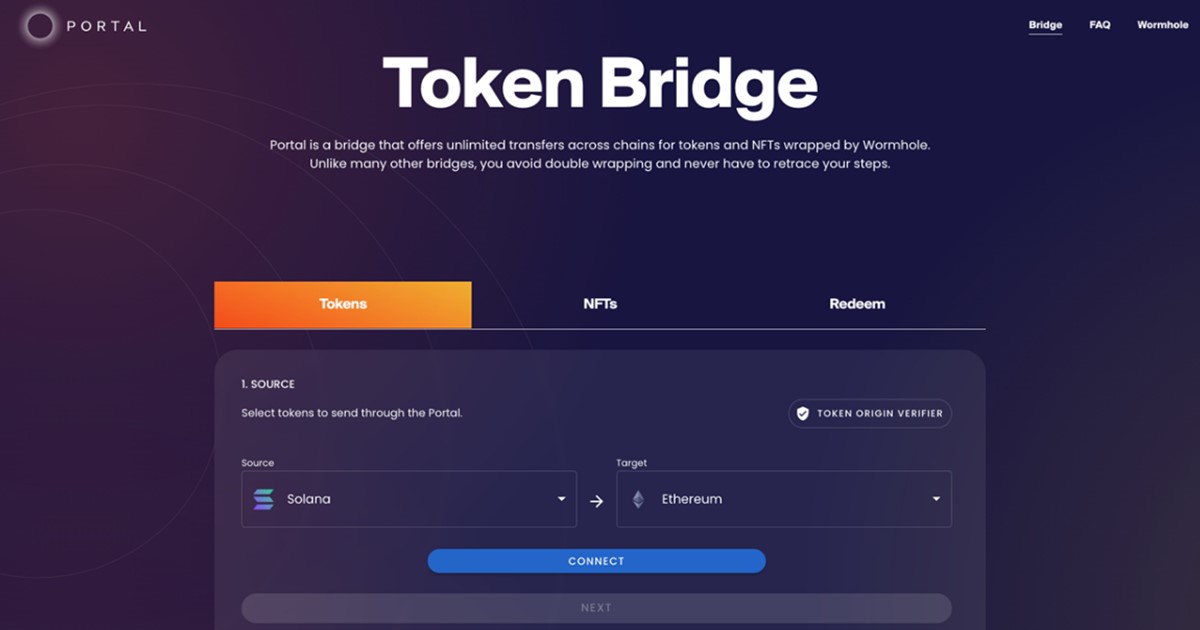

As the interest in cross-bridges expands, there are now certain blockchain bridges that enable users to transfer crypto from one chain to multiple chains. Below we can use Wormhole as an example.

Wormhole network is a generic cross-chain message passing protocol. Wormhole supports multiple chains including Ethereum, Solana, Binance Smart Chain, Polygon, Fantom, Aptos, Arbitrum and many others. Wormhole enables cross-chain communications with its network of 19 guardians. Their sole purpose is to track the activities taking place on different chains to ensure the security of cross-chain transactions.

In a cross-chain transaction, Wormhole emits a message from the source chain. The guardians receive the message, verify it, then sign the message and lock the native tokens on the source chain. Transactions need a two-thirds majority of the guardians to pass the verification. After verification, Wormhole relays the message to the destination chain, which then processes and finalises the cross-chain transaction.

Portal Bridge is a bridge application built on top of Wormhole. Source: Portal.

Generic cross-chain protocols have become an expanding segment in the blockchain space, with Wormhole as one example among many, such as LayerZero, Axelar and Nomad.

Interoperable Blockchains: Polkadot, Cosmos

Beyond cross-chain bridges, interoperable blockchains are facilitating communications among various blockchains further down to the infrastructure level. Blockchains like Polkadot and Cosmos bring laser focus in making it easier and safer for different independent blockchains to interact.

Polkadot facilitates interconnectivity with a dual-blockchain architecture consisting of a Relay Chain and Parachains. Organisations and projects can create and control their own parachains, which link the Relay Chain, Polkadot’s primary chain. The Relay Chain is also capable to connect Polkadot’s parachains to other blockchains, e.g., Bitcoin and Ethereum, with its cross-chain bridge feature.

Within the Polkadot blockchain structure, parachains connect to Polkadot by leasing a “slot” on the Relay Chain. Currently, Polkadot supports a limited number of about 100 parachains, i.e., about 100 “slots”, according to estimations. As the number of slots is limited, Polkadot allocates the slots mainly by an on-chain auction.

Positioning as “The Internet of Blockchains”, Cosmos facilitates rapid and efficient communications between blockchains. The Cosmos Hub servers as the primary chain to connect different “zones”-independent chains-within the Cosmos network structure. Through the Inter-Blockchain Communication Protocol (IBC), Cosmos enables data and value to be exchanged freely between zones.

In contrasts to Polkadot, the Cosmos ecosystem does not implement an auction system. Instead, any individual can use the Cosmos Software Development Kit (Cosmos SDK) to create a blockchain at their discretion. There are more than 272 apps and services in the Cosmos network, including Binance Smart Chain, Terra and crypto.org.

IBC connects 54 different blockchains including the Cosmos Hub. Source: Map of Zones.

Inter-Blockchain Communication Protocol (IBC)

As part of Cosmos Stargate upgrade in March 2021, Inter-Blockchain Communication Protocol (IBC) brings an interchain infrastructure to Cosmos. It connects different custom blockchains in the Cosmos ecosystem, enabling each zone to talk all the other zones.

IBC provides the infrastructure to establish secure connections and authenticate data transfers between chains. It aims to enables developers to create a broad range of cross-chain applications including token transfers, NFT transfers and oracle data feeds. For example, IBC allows a Cosmos chain to use funds that originate on Ethereum, and possibly record events in a Corda distributed ledger.

Are Cross-Chain Bridges Safe?

The demand for cross-chain transfers has been significantly increasing as cryptocurrencies continue to gain widespread adoption. While cross-chain bridges offer many benefits, they also carry potential risks such as theft and hacking. Asset safety has become a major concern in cross-chain bridges. The significant amount of assets sitting on bridges make them a prime target for hackers seeking to exploit and steal.

The safety concern revolves around the trust mechanism, specifically the validation process of transactions and asset custody on cross-chain bridges.

Cross-chain bridges vary by design. As one prevalent type of cross-chain bridges, centralized bridges rely on a small group of entities to validate transactions and act as the custodian of bridged assets. The custodians are responsible for confirming user deposits, locking up tokens, and minting tokens on the destination chain.

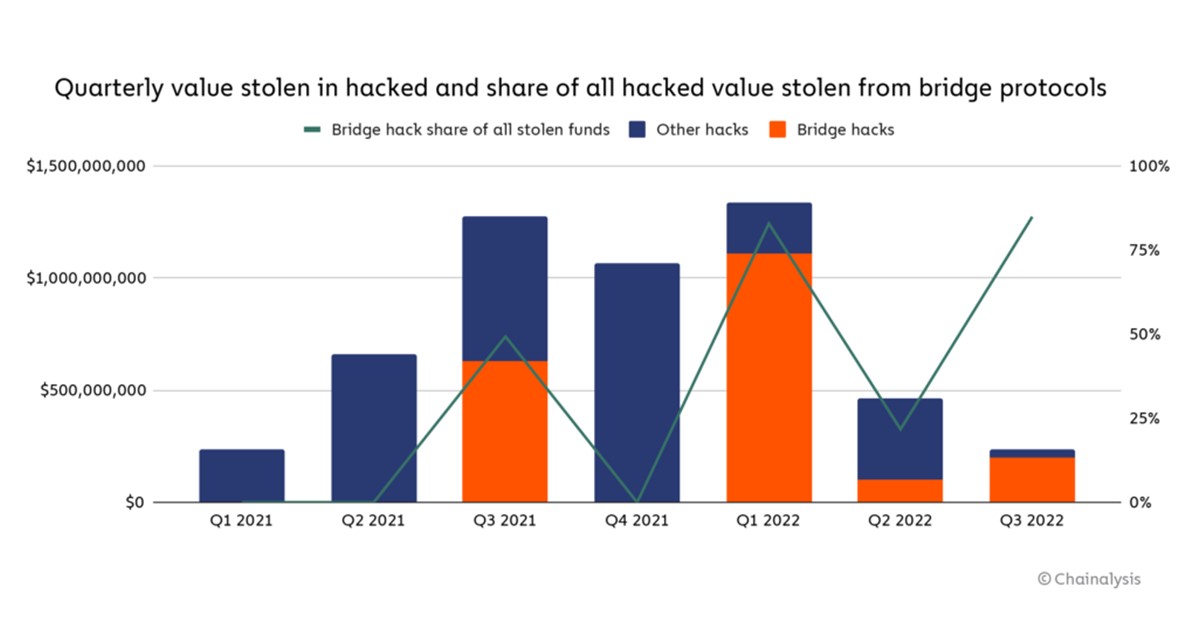

As of Q3 2022, US$2 billion in cryptocurrency has been stolen across 13 cross-chain bridge hacks. Source: Chainalysis.

In short, the trust assumption of centralised bridges is dependent on the reputation of the bridge operator and the validator(s). This creates a central point of failure, leaving room for vulnerabilities and risks.

Bridge attacks can target the asset custodians, issuers, and other entities involved. For instance, hackers can hijack a majority of the validators to steal users’ funds or manipulate the system to generate fake proofs, mint new tokens without the necessary deposits.

Potential risk of Using Decentralised Cross-Chain Bridges

Meanwhile, decentralized, trustless cross-chain bridges leverage the security of the underlying blockchain with the objective to reduce dependency on trust. These decentralised cross-chain bridges operate through the use of oracles, smart contracts and algorithms to manage the asset bridging.

Exploitation of smart contracts remain a concern. Hackers may trick the smart contract into forwarding invalid messages for token minting or redemption. They can also alter or corrupt the oracle data sources.

Significant decentralised cross-chain bridge hacks, such as the PolyNetwork exploit resulting in a loss of $600 million (2021), and the $325 million Wormhole attack (2022), have occurred due to the exploitation of vulnerable smart contracts.

Despite the potential risks, it is important to acknowledge the benefits of cross-chain bridges. To sustain their relevance and benefit the overall development of the blockchain space, cross-chain bridges must progress beyond its current state to effectively address security concerns.

More Cross-Chain Solutions: Centralised Exchanges

Last but not least, you can transfer crypto tokens across different chains using a crypto exchange. Converting tokens can be easy and safe by using a trustworthy exchange.

For example, to exchange Bitcoin (BTC) for Ethereum (ETH), you must first deposit your BTC to a crypto exchange. Should a suitable trading pair exist, you can purchase ETH using BTC directly. If not, you can sell your BTC for stablecoins and use those to purchase ETH. Finally, you may withdraw ETH to a crypto wallet based on the Ethereum blockchain.

It’s important to note that if the exchange does not support the blockchain of your token, you may encounter difficulties with depositing or withdrawing the token.

Final Thoughts

As the blockchain space industry shifts towards a multi-chain future, cross-chain solutions hold great potential to unlock substantial value for multiple blockchain ecosystems. These solutions offer interoperability between separate, isolated blockchains, allowing users to maximise the value of their crypto assets.

The surging demand for cross-chain transfers has spurred the emergence of various innovative cross-chain solutions, including Wrapped Tokens, bridges, cross-chain DeFi platforms, interoperable blockchains and others.

While cross-chain solutions bring many benefits, they also carry potential risks for users. It is up to each user to determine the best method for transferring tokens between blockchains considering their individual goals, time constraints and risk tolerance.

Want to stay on top of the blockchain and digital asset market?

Sign up below to receive HashKey insights and knowledge in your inbox.